Auto Loan Payment Calculator: Calculate Your Monthly Payments

Auto loans are a popular financing option for purchasing a new or used vehicle. With auto loan payment calculators, you can easily determine your monthly payment amount based on factors such as the loan amount, interest rate, and loan term. In this blog, we will discuss the importance of using an auto loan payment calculator, the different types of calculators available, and how to use one to make informed financial decisions.

Firstly, it's important to understand the benefits of using an auto loan payment calculator. By using one, you can determine how much you can afford to spend on a vehicle, which can help you avoid taking on a loan that is beyond your means. You can also compare different loan options and interest rates to find the most affordable solution that fits your budget.

There are different types of auto loan payment calculators available, including the free auto loan calculator, the simple auto loan calculator, and the best auto loan calculator. With the online auto loan calculator, you can input your loan details, including the loan amount, interest rate, and loan term, to see your estimated monthly payment. The car loan payment calculator is ideal for those who want to know how much they will need to budget each month for their auto loan payments.

For those who are considering purchasing a new car, the new car loan calculator can help them estimate their financing options. Similarly, the used car loan calculator can help those looking for a pre-owned vehicle to make informed buying decisions. The monthly auto loan calculator enables users to calculate loan payments based on their monthly budget, while the interest rate for auto loan calculator can help them determine how much they will need to pay in interest over the life of the loan.

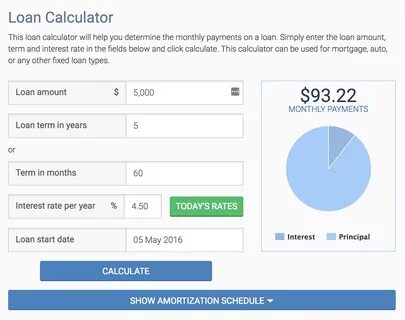

Using an auto loan payment calculator is easy. Simply input the loan amount, interest rate, and loan term to see your estimated monthly payment. In addition, you can adjust the numbers to see how different loan terms and interest rates will affect your monthly payment. By using an auto loan calculator, you can save time and make informed financial decisions that fit your needs and budget.

In conclusion, the use of an auto loan payment calculator is an essential tool for anyone considering an auto loan. With different types of calculators available, you can easily determine your monthly payment and compare different loan options to find the most affordable solution. By using an online auto loan calculator, you can make informed financial decisions and ensure that you are not taking on a loan that is beyond your means.

Auto Loan Payment Calculator

What is an Auto Loan Payment Calculator?

An auto loan payment calculator is an online tool that helps you calculate and plan your monthly car payment. Simply input the amount you plan to finance, the length of the loan, and the interest rate offered, and the calculator will instantly provide you with an estimate of your monthly payment. The calculator also allows you to experiment with different scenarios, such as lengthening or shortening the loan term, to see how they will affect your payment amount.

Why Use an Auto Loan Payment Calculator?

An auto loan payment calculator is an essential tool that can be used to maximize your car-buying budget. Here are some reasons why:

- Budget planning: By using an auto loan payment calculator, you can determine what your monthly payment will be, and adjust your budget accordingly.

- Comparison shopping: Often, different lenders will have different interest rates, loan lengths, and financing terms. An auto loan payment calculator allows you to quickly compare different lenders and their offers.

- Save time: Instead of spending hours calculating your loan payments by hand or on a spreadsheet, an auto loan payment calculator can provide you with an instant estimate.

- Stress-free car buying: Knowing what you can afford before you even walk into the dealership can take a lot of the stress out of car buying.

How to Use an Auto Loan Payment Calculator

Using an auto loan payment calculator is simple. Here's how to use one:

- Gather your information: Before you start, you'll need to know the amount you plan to finance, the length of the loan, and the interest rate offered.

- Input your information: Enter your information into the calculator fields.

- Experiment with scenarios: Play around with different scenarios, such as increasing or decreasing the length of your loan term.

- Review your options: Once you've input your information, the calculator will provide you with an estimate of your monthly payment.

Remember to keep in mind that this is just an estimate, and that your actual payment may vary depending on factors such as taxes, fees, and any down payment you make.

The Benefits of Using an Auto Loan Payment Calculator

An auto loan payment calculator is an invaluable tool for anyone in the market for a new vehicle. By using a calculator, you can save time, reduce stress, and find the best possible loan terms and monthly payment for your budget. So the next time you're considering a new car purchase, be sure to use an auto loan payment calculator to make an informed decision.

Free Auto Loan Calculator

What is an Auto Loan Calculator?

An auto loan calculator is an online tool that helps you estimate your monthly car payments based on factors such as the purchase price, down payment, interest rate, and loan term. These calculators are often available for free on car dealership websites, financial institution sites, and independent car loan websites.

How to Use a Free Auto Loan Calculator

Using a free auto loan calculator is easy. You'll typically start by entering the car's purchase price, followed by your down payment amount. Then, you'll enter the interest rate and loan term to calculate your monthly payments. Some calculators may also ask for additional information such as taxes, fees, and trade-in value, which can affect the final price.

Once you've entered all the necessary information, the calculator will generate an estimated monthly payment. You can adjust the numbers as needed to see how different factors can impact your payments. This can be especially helpful when deciding which car to purchase or narrowing down your loan options.

Why Use a Free Auto Loan Calculator?

Using a free auto loan calculator offers several benefits, including:

- Accuracy: Unlike manual calculations, a loan calculator uses complex algorithms to provide precise estimates.

- Time-Saving: Calculating your monthly car payments by hand can be time-consuming. With a free auto loan calculator, you can receive an estimate within minutes.

- Budgeting: Knowing your estimated monthly payments can help you plan and manage your finances accordingly.

- Comparison Shopping: By comparing different loan options and interest rates, you can find the best car loan for your needs and budget.

Conclusion

Overall, a free auto loan calculator can be an invaluable tool for anyone looking to purchase a car. By providing quick and accurate estimates of your monthly payments, it can help you make informed decisions and stay within your budget. Whether you're buying a new or used car, be sure to use an auto loan calculator before making any final purchasing decisions.

Simple Auto Loan Calculator

Best Auto Loan Calculator

Looking for the best auto loan calculator can be an overwhelming task, especially with the numerous options available. However, taking the time to choose the right one can save you money and help you make informed decisions regarding your car loan obligations.

So, what exactly is an auto loan calculator? It is a digital tool that helps you estimate the total cost of an auto loan by taking into account several factors such as the loan amount, interest rate, loan term, and other relevant fees. With an auto loan calculator, you can have an idea of the monthly payment and the total cost of the loan before approaching a lender. This way, you can compare loans from different lenders and choose the one that suits your budget.

Now, let's look at some of the factors to consider when choosing the best auto loan calculator:

- Accuracy: A good auto loan calculator should provide accurate estimates of the loan costs. One way to achieve this is to check if the calculator takes into account additional fees such as taxes, maintenance cost or insurance premiums.

- User-friendliness: A good auto loan calculator should be user-friendly, easy to navigate, and provide clear explanations of the calculated results.

- Customizability: Some auto loan calculators offer advanced features such as the ability to adjust the loan tenure, interest rate, and down payment amount. These features allow you to play around with different scenarios and choose the best loan option for you.

- Accessibility: The best auto loan calculators should be easily accessible and available on multiple platforms such as desktop, mobile or tablet devices.

With these factors in mind, here are some of the best auto loan calculators available:

| Bankrate | Bankrate auto loan calculator is a popular tool that offers accurate estimates of the loan costs while taking into account various factors. It is easy to use and provides clear explanations of the calculated results. |

| Cars.com | Cars.com auto loan calculator is another excellent tool that offers customizability options, allowing the user to adjust various parameters such as interest rate and loan term. |

| Capital One | Capital One auto loan calculator is a user-friendly tool that provides clear and straightforward answers to your car loan questions. The calculator is easily accessible on multiple devices and has a sleek and modern interface. |

Ultimately, choosing the best auto loan calculator comes down to personal preference and the features that matter most to you. However, ensure you evaluate the accuracy, accessibility, customizability, and user-friendliness of the calculator before making your decision.

In conclusion, an auto loan calculator is a valuable tool that can help you understand the costs of a car loan and make informed decisions when choosing a lender. By taking the time to choose the right calculator, you can potentially save money and avoid hidden fees.

Online Auto Loan Calculator

As a smart shopper, you're likely researching financing options before going to a dealership. After all, securing financing before shopping for a car can give you a better idea of what cars fit your budget. Fortunately, thanks to the internet, you no longer have to rely on a dealership to calculate a monthly payment for you. Instead, you can use an online auto loan calculator to figure out what you can afford. An auto loan calculator is a simple tool that allows you to enter the principal amount of the loan, the interest rate, and the number of months you will pay it back. Once you enter all of the required information, the calculator will provide you with a breakdown of the monthly payment. Using an online auto loan calculator can give you a lot of valuable information. It can help you determine the total cost of the loan, including interest, help you understand how different interest rates affect your monthly payment, and help you see the difference between different loan terms. With this information in hand, it's easier to shop around for the best loan rates and find a loan that's right for you. So, how do you use an online auto loan calculator? It's easy! Here's how:- Know what you can afford. Before you start shopping for a car or an auto loan, it's important to have a good understanding of your monthly budget. Look at your income, expenses, and other financial obligations to determine how much you can realistically afford to put towards a car each month.

- Calculate the cost of the car. Once you've decided on your budget, it's time to determine how much car you can afford. You can either use the total loan amount or the price of the car including any down payment and tax/title fees.

- Select your loan term. Most loan calculators give you the option to choose the term of your loan. Keep in mind that a longer loan term can result in a lower monthly payment, but will also result in paying more interest over time.

- Enter the interest rate. You can either use a general rate or use any pre-approved loan rates you may have received from lenders.

- Click calculate. Once you have entered all the necessary information, click on the calculate button to get your monthly payment amount.

Car Loan Payment Calculator

Are you thinking of financing your new car purchase but are unsure of the monthly payments? A car loan payment calculator can provide you with a detailed breakdown of your loan payments, interest rate, and terms. This useful tool can help you determine your budget and make informed decisions based on your financial situation.

How Does a Car Loan Payment Calculator Work?

A car loan payment calculator is an online tool where you enter the total car price, down payment, interest rate, loan term, and any trade-in or rebate amount. The calculator then calculates your monthly car loan payments and other important details, such as the total interest paid and the estimated payoff date.

Advantages of Using a Car Loan Payment Calculator

Using a car loan payment calculator has several benefits:

- Provides a Clear Picture of Your Loan Payments. A car loan payment calculator can show you how much you need to pay monthly, helping you plan your finances accordingly.

- Helps You Choose the Best Loan Option. With a car loan calculator, you can compare different loan options and see which one suits your budget and requirements.

- Estimates Total Interest Paid. A car loan calculator also shows you the total interest paid over the loan term, giving you an idea of the extra amount you'll be paying in addition to the car's cost.

- Allows You to Adjust Loan Terms. Using a car loan calculator, you can adjust the loan term, down payment, and other factors to see how it affects your monthly payments.

Factors to Consider

When using a car loan payment calculator, keep these factors in mind:

- The Interest Rate. Interest rates can vary depending on your credit score, income, and other factors. A higher interest rate means higher monthly payments and more interest paid over the loan term.

- The Loan Term. A longer loan term can mean lower monthly payments but also results in paying more total interest. A shorter loan term means higher monthly payments but less interest paid in total.

- The Down Payment. A larger down payment reduces the loan amount, resulting in lower monthly payments and less interest paid over the loan term.

Conclusion

A car loan payment calculator is a valuable tool that can help you determine your monthly payments, compare loan options, and estimate the total interest paid. By taking into account the factors mentioned above, you can make informed decisions about your car loan and stay within your budget. Use a car loan payment calculator today to get a clear picture of your auto loan payments!

New Car Loan Calculator

Buying a new car can be an exciting time, but it's easy to get caught up in the thrill of picking out a shiny new ride and forget about the financial aspect. It's important to consider your budget and plan your expenses accordingly. One of the most important things to consider when taking out a loan for a new car is the amount of interest you'll pay over time.

This is where a new car loan calculator can come in handy. With this tool, you can estimate the total cost of your car loan and figure out how much you'll need to pay each month. Here's a comprehensive guide on how to use a new car loan calculator.

Step 1: Find a New Car Loan Calculator

The first step is finding a new car loan calculator. There are many free online calculators available that you can use. One popular option is Bankrate's auto loan calculator, which allows you to input your loan amount, interest rate, and loan term to estimate your monthly payments.

Step 2: Input Your Loan Information

Next, you'll need to input your loan information into the calculator. This should include the total cost of the car, the interest rate you've been offered, and the length of your loan term.

Step 3: Consider Down Payments and Trade-Ins

If you plan on making a down payment or trading in your old car, these amounts can also be factored into the total cost of your loan. This will give you a more accurate estimate of your monthly payments.

Step 4: Experiment with Different Loan Terms and Interest Rates

One of the benefits of using a new car loan calculator is that you can experiment with different loan terms and interest rates to see how they would impact your monthly payments. For example, if you can't afford a high monthly payment, you may want to consider extending the length of your loan term to lower your payments.

Step 5: Review and Compare your Results

Once you've input all your information into the calculator and experimented with different loan terms and interest rates, you should have a solid estimate of your monthly payments. It's important to review these results carefully and compare them with your budget to make sure you can afford the payments.

Conclusion

A new car loan calculator is an essential tool for anyone considering taking out a loan to finance a new vehicle. By inputting your loan information and experimenting with different loan terms and interest rates, you can estimate the total cost of your loan and determine how much you'll need to pay each month. This will help you plan your budget accordingly and ensure that you can afford your car loan payments.

Used Car Loan Calculator

Are you considering buying a used car? Or maybe you're already in the process of looking for one? Whatever your reason is, it's crucial to understand the cost and expenses that come with owning a used vehicle. More often than not, used car shoppers avail themselves with a used car loan. This is where a used car loan calculator comes in handy.What is a Used Car Loan?

A used car loan is a type of auto loan used to finance the purchase of a pre-owned vehicle. When you take out a used car loan, the lender pays the car's balance upfront, and you pay back the loan amount through monthly payments that include an interest rate.How to Use a Used Car Loan Calculator

Several financial institutions offer used car loan calculators, and most of them work the same way. Here are the essential steps to use a used car loan calculator:- Enter the car price

- Determine the downpayment, if any

- Enter the annual interest rate

- Select the loan terms or repayment length

- Hit the calculate button

Why is a Used Car Loan Calculator Important?

A used car loan calculator provides precise details on monthly payments, which helps you make better financial decisions. It allows you to see the realistic cost of owning a car beyond just the sticker price. Hence, you can choose the best option that suits your budget and financial capabilities.Final Thoughts

A used car loan calculator is an essential tool that helps make the car financing process easier. By entering specific information, you can avoid any financial surprises when purchasing a used vehicle. It's essential to consider your finances and budget before buying a car, and the calculator helps you make informed decisions.Monthly Auto Loan Calculator

When it comes to buying a car, financing can be one of the most difficult aspects to deal with. Not only do you need to know how much you need to borrow, but you also need to know how much interest you'll pay and how long it will take to pay off your loan. All of these factors can be overwhelming for a car buyer.

That's where a monthly auto loan calculator comes in. This tool can help you figure out all the numbers you need to make informed decisions about your car financing. Here's how it works:

- Loan Amount: You enter the amount you need to borrow for your car loan.

- Interest Rate: You enter the interest rate you will be charged for your loan.

- Loan Term: You enter the number of months you have to pay back your loan.

With these three pieces of information, the monthly auto loan calculator will figure out your monthly payment. This way, you can see exactly how much you'll be paying for your car each month. You can also adjust the numbers to see how different loan amounts, interest rates, and loan terms will affect your monthly payment.

Using a monthly auto loan calculator can help you make informed decisions about your car financing. It can also save you a lot of time and effort. Instead of manually calculating your monthly payment for different loan scenarios, you can simply enter the numbers into the calculator and see the results instantly.

Another benefit of using a monthly auto loan calculator is that it can help you budget for your car payment. By knowing how much you'll be paying each month, you can plan ahead and make sure you have enough money to cover your payment. You can also adjust your budget or your car selection based on what you can afford to pay each month.

In summary, a monthly auto loan calculator is a useful tool for anyone who is looking to finance a car. It can help you figure out your monthly payment, adjust your loan scenarios, and budget for your car payment. By using a monthly auto loan calculator, you can take the guesswork out of car financing and make informed decisions about your car purchase.

Interest Rate For Auto Loan Calculator

An auto loan calculator is a useful tool for anyone who is thinking of financing a car. By using this calculator, you can get an idea of how much your monthly payments will be, what your total loan amount will be, and what interest rate you will be paying. In this blog post, we will focus on interest rates for auto loan calculators. An auto loan calculator takes into account several factors when calculating your interest rate: your credit score, the length of the loan, the amount of the loan, and the type of car you are purchasing. Depending on these factors, your interest rate can range from the low single digits to upwards of 20%. When it comes to credit scores, the higher your score, the lower your interest rate will be. Borrowers with excellent credit scores (typically considered to be 700 or above) can expect to receive interest rates in the low single digits. On the other hand, borrowers with poor credit scores (typically below 600) can expect to receive much higher interest rates. The length of your loan will also impact your interest rate. Generally, the shorter your loan term, the lower your interest rate will be. For example, a three-year loan will typically have a lower interest rate than a five-year loan. This is because lenders view shorter loans as less risky. The amount of your loan will also play a role in determining your interest rate. Generally speaking, the higher the loan amount, the higher the interest rate will be. Lenders view larger loans as more risky and will typically charge higher interest rates to compensate for that risk. Finally, the type of car you are purchasing can also affect your interest rate. Newer cars often come with lower interest rates than used cars. This is because newer cars are less likely to break down and require expensive repairs, making them less risky for lenders. Using an auto loan calculator is simple. You can easily find them online and they are free to use. Simply enter in the loan amount, the length of the loan, the interest rate, and any other pertinent information (such as the make and model of the car you are purchasing) and the calculator will do the rest. In summary, your interest rate for an auto loan is determined by several factors including your credit score, the length of your loan, the amount of your loan, and the type of car you are purchasing. By using an auto loan calculator, you can get an idea of what your monthly payments will be and what your total loan amount will be. This can help you make an informed decision when it comes to financing your car. Remember that the lower your interest rate, the less money you will ultimately pay for your car, so make sure to shop around for the best interest rate possible.Frequently Asked Questions

1. What is an auto loan payment calculator?

-An auto loan payment calculator is an online tool that helps you determine your monthly car loan payments, taking into account the loan amount, interest rate, and loan term.

2. How accurate are auto loan calculators?-Auto loan calculators are generally very accurate, but the results may vary depending on the information you provide and the lender. It's always a good idea to double-check the numbers with the lender before finalizing a loan.

3. Can I use an auto loan calculator for a used car loan?-Yes, most auto loan calculators can be used for both new and used car loans. Simply input the loan amount, interest rate, and loan term for the used car loan you're considering.

4. Why should I use an auto loan calculator?-Using an auto loan calculator can give you a better understanding of the loan amount, interest rate, and loan term you can afford, and help you make an informed decision about buying a new or used car.

5. Are there any fees to use an online auto loan calculator?-No, online auto loan calculators are usually free to use, and can be found on many auto finance websites. Be sure to double-check for any hidden costs or fees associated with a loan before applying.